Best Practices for Risk Management in Freelance Accounting

In today’s fast-changing financial environment, freelance accountants face not only the challenges of delivering accurate and timely services but also the responsibility of managing risks effectively. Whether you work with startups, small businesses, or global clients, risk management is a non-negotiable skill that can protect your reputation, ensure compliance, and safeguard client trust.

This guide explores the best practices for risk management in freelance accounting—covering everything from regulatory compliance and data protection to financial forecasting and client management. By integrating these strategies, you can strengthen your freelance business and deliver higher value to your clients.

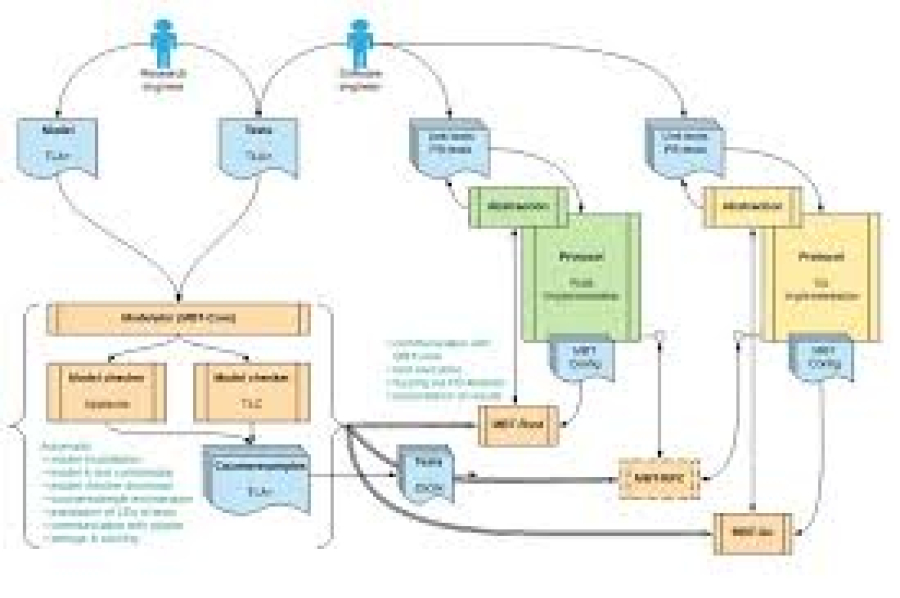

Long Description

1. Understanding Risk in Freelance Accounting

Risk in freelance accounting refers to potential events, actions, or situations that can negatively impact your financial services, client relationships, or overall business operations. These risks can be:

Regulatory Risks: Changes in tax laws, accounting standards, or industry regulations.

Operational Risks: Errors in financial reports, missed deadlines, or software malfunctions.

Reputational Risks: Negative feedback, data breaches, or unethical practices.

Financial Risks: Cash flow issues, underpricing, or non-payment by clients.

Recognizing these risks early is the foundation of effective risk management.

2. Conduct Thorough Client Due Diligence

Before onboarding a new client, it’s critical to verify their legitimacy and financial health. Steps include:

Reviewing their business registration and legal status.

Checking creditworthiness or payment history.

Requesting references from previous accountants or service providers.

Understanding their industry-specific compliance requirements.

This process ensures you avoid clients with high default risks or unethical practices.

3. Maintain Accurate and Secure Financial Records

Accuracy is the lifeblood of accounting. Any mistake can result in legal issues, client dissatisfaction, and even penalties. Best practices include:

Using reliable accounting software like QuickBooks, Xero, or Zoho Books.

Setting up version control for financial files to avoid data loss.

Scheduling periodic reconciliations to detect discrepancies early.

Keeping off-site backups for disaster recovery.

A well-structured record-keeping system helps mitigate operational and compliance risks.

4. Prioritize Data Security and Privacy Compliance

With increasing cyber threats, protecting sensitive financial data is essential.

Implement two-factor authentication (2FA) for all accounting platforms.

Use end-to-end encrypted cloud storage.

Regularly update antivirus and anti-malware software.

Comply with GDPR, CCPA, or other regional data protection laws.

Strong data protection practices reduce the risk of breaches, fines, and reputational damage.

5. Stay Updated with Regulatory Changes

Laws and accounting standards evolve regularly. Failing to adapt can lead to compliance issues.

Subscribe to newsletters from tax authorities and professional bodies.

Attend webinars and professional workshops.

Join online forums for accountants to exchange updates and insights.

Being proactive ensures you provide accurate, compliant services, even in rapidly changing environments.

6. Draft Clear and Comprehensive Contracts

A well-drafted contract is one of the most powerful risk management tools for freelancers. Your agreement should cover:

Scope of work and deliverables.

Payment terms and late payment penalties.

Confidentiality and non-disclosure clauses.

Dispute resolution mechanisms.

Termination conditions.

Clear contracts reduce misunderstandings and provide legal protection.

7. Adopt a Risk-Based Approach to Auditing

When auditing financial records, prioritize areas most susceptible to errors or fraud.

Focus on high-value transactions and unusual activity.

Verify compliance with tax and regulatory frameworks.

Use data analytics tools to detect patterns and anomalies.

This approach ensures efficiency and reduces the likelihood of missing critical issues.

8. Manage Currency and International Payment Risks

For freelancers working with global clients:

Use multi-currency accounting software to track exchange rate fluctuations.

Set clear payment terms in the preferred currency.

Consider hedging strategies for large transactions.

Choose secure, low-fee international payment platforms like Wise, PayPal Business, or Payoneer.

This protects your earnings from exchange rate volatility and transaction delays.

9. Build a Contingency Plan for Operational Disruptions

Unexpected events—such as system outages, illness, or natural disasters—can disrupt your work.

Keep a list of backup accountants or collaborators.

Store essential documents on secure cloud platforms.

Use remote work tools to continue operations from anywhere.

A contingency plan ensures you can maintain service continuity in emergencies.

10. Obtain Professional Liability Insurance

Even with the best processes, mistakes can happen. Professional liability insurance (also known as errors and omissions insurance) provides coverage for:

Client lawsuits due to financial errors.

Costs associated with legal defense.

Compensation for client losses caused by mistakes.

This safeguard protects your financial stability in case of legal disputes.

11. Monitor and Review Your Risk Management Process Regularly

Risk management is not a one-time task.

Review your strategies quarterly or biannually.

Adjust processes based on changes in laws, technology, or client needs.

Keep performance metrics to assess the effectiveness of risk management measures.

Continuous improvement ensures your approach remains relevant and effective.

12. Educate Clients on Risk Awareness

A collaborative approach to risk management benefits both you and your clients.

Explain compliance requirements and deadlines.

Share best practices for record-keeping.

Encourage them to adopt secure payment and communication channels.

This not only strengthens trust but also reduces the likelihood of client-side issues impacting your work.

13. Leverage Technology for Risk Mitigation

Modern tools can significantly reduce accounting risks:

AI-powered reconciliation tools to detect mismatches instantly.

Cloud-based workflow automation to avoid missed deadlines.

Blockchain-powered ledgers for immutable and transparent records.

Tech integration allows you to work smarter while reducing human error.

Conclusion

For freelance accountants, mastering risk management is essential to maintain accuracy, compliance, and client trust. By implementing these best practices—from client due diligence and secure record-keeping to proactive regulatory updates and technology integration—you can safeguard your freelance business against potential threats.

by Emily

by Emily